Corporate Governance

Basic Policy on Corporate Governance

Purpose

The purpose of this Basic Policy on Corporate Governance (hereinafter “the Basic Policy”) is for MICRONICS JAPAN CO., LTD., (hereinafter “MJC”) and its Group companies (hereinafter “the MJC Group”) to achieve sustainable growth and increase the medium- to long-term corporate value through the pursuit of more ideal corporate governance.

Basic Approach to Corporate Governance

MJC is committed to boosting its corporate value and to fulfilling its corporate social responsibility. An important issue toward that end is to enhance the checking function of the management setup from the standpoint of ensuring the appropriateness and transparency of management decision-making. Accordingly, MJC will enhance its corporate governance through proper fulfillment of the current roles and duties of the Board of Directors and the Audit & Supervisory Board and based on the Basic Policy for Establishing Internal Control Systems.

- Ensuring Shareholder Rights and Equality

- Appropriate Cooperation with Stakeholders Other Than Shareholders

- Ensuring Appropriate Information Disclosure and Transparency

- Duties of the Board of Directors, Etc.

- Dialogue with Shareholders

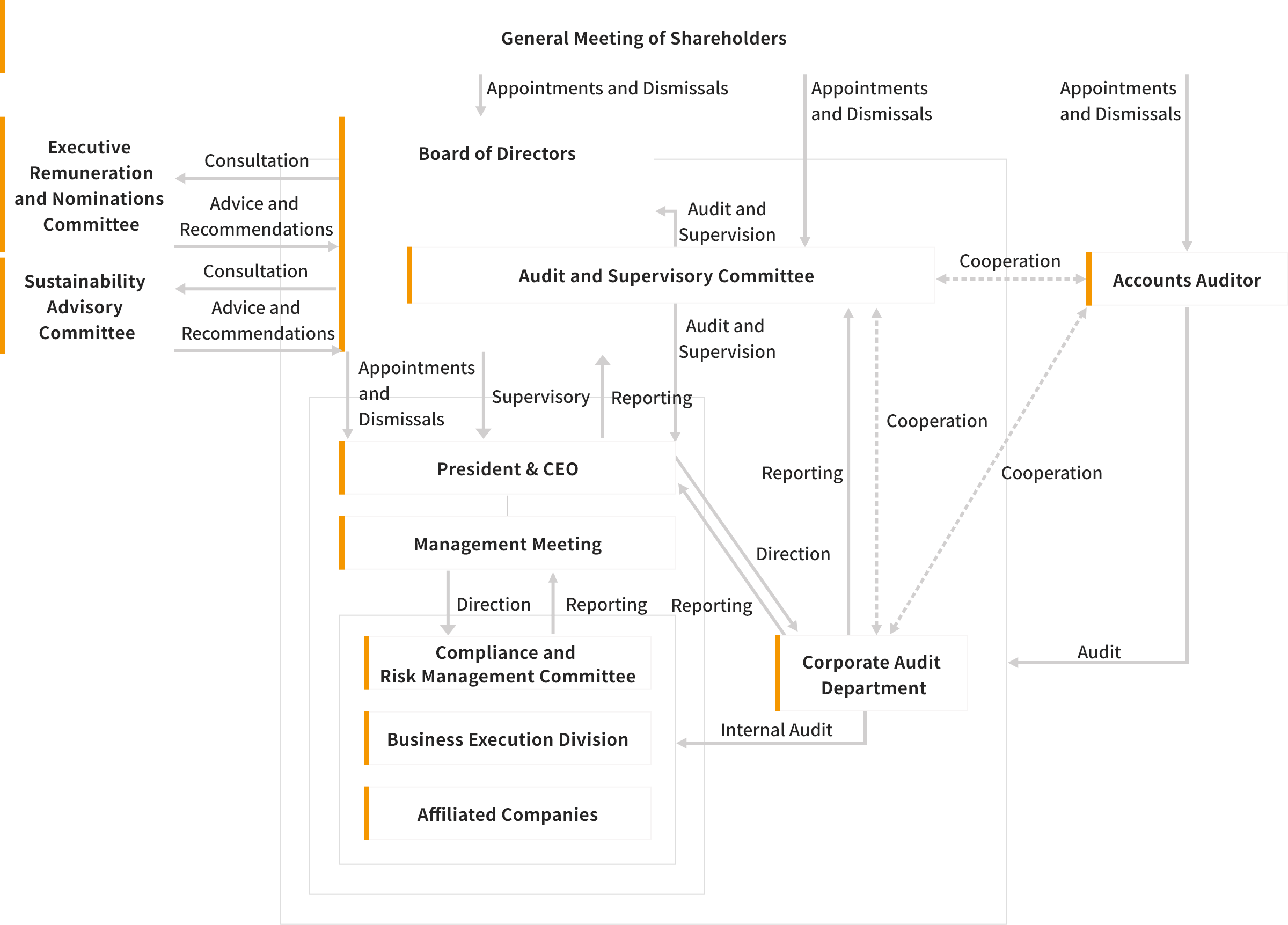

Organization chart

Basic Approach and Development Status of the Internal Control System

Our Board of Directors has passed the following resolution on the 'Basic Policy for Establishing an Internal Control System.’

- System for Ensuring Compliance with Laws and Regulations in Executive Duties of Directors and Employees

- (1)Recognizing that compliance is essential for the continued existence of a company, we have established compliance regulations and developed a Compliance Handbook (Code of Conduct) to ensure that all executives and employees act in accordance with laws, the company’s articles of incorporation, internal rules, and corporate ethics. Additionally, we have introduced the MJC Helpline, which enables employees to report or consult on potential legal violations or breaches of the Code of Conduct. This helpline includes an external reporting channel to ensure anonymity and protect whistleblowers from any disadvantageous treatment.

- (2) MJC has established a Management Audit Department, which conducts internal audits focused on governance and risk management. Through these audits, we identify and address internal control challenges, strengthening corporate governance and ensuring effective oversight. This approach extends to subsidiaries and affiliated organizations, where we emphasize internal control processes to enhance monitoring functions.

- (3)We maintain a strict policy of zero involvement with antisocial forces that threaten public order and safety. In cases where such entities attempt to engage with MJC, we work closely with external professional organizations, including law enforcement authorities, to take firm and resolute action across the organization.

- System for Preserving and Managing Information Related to Directors' Executive Duties

MJC appropriately preserves and manages documents, including electronic records, and other important information related to the execution of directors' duties in accordance with laws and internal regulations. Additionally, we ensure proper disclosure of necessary information in compliance with legal requirements and securities listing regulations.

- Regulations and Systems for Managing Risk of Loss

MJC has established a Compliance & Risk Management Committee based on the Basic Risk Management Regulations, overseeing company-wide risk assessment and policy decisions. Through this committee, we proactively implement risk management activities across the organization.

To mitigate risks that may significantly impact business operations, we identify, analyze, and evaluate potential threats in advance. We then develop appropriate countermeasures to minimize losses and ensure a structured response when risks materialize. Additionally, we continuously monitor risk management status and conduct regular reviews to enhance overall resilience.

- System for Ensuring the Efficient Execution of Directors' Duties

To ensure the efficient execution of directors' duties, the Board of Directors makes decisions on fundamental management policies, legally mandated matters, and other key business issues. It also functions as an overseeing body, monitoring the implementation of these decisions.

Additionally, as a guiding principle for decision-making, MJC and subsidiaries (the Group) have established a corporate philosophy that outlines our mission, vision, and shared values:"MJC's Mission" – Defines the fundamental purpose of our Group’s existence.

"MJC's Vision" – Illustrates the future aspirations of the Group.

"Our Core Values" – Represents the essential beliefs and principles shared by all employees to achieve our mission and vision.

To realize these goals, we formulate a mid-term business plan (FV26) and annual operational plans, ensuring a clear roadmap for sustainable growth.

Furthermore, we have established a Management Conference, chaired by the President, to enhance discussions at the Board of Directors through preliminary deliberations. Within the scope of delegated authority, this conference also reviews business execution and strategic initiatives. - System for Ensuring Proper Business Operations Across the Corporate Group

MJC manages its subsidiaries in accordance with the Affiliated Company Management Regulations. Under the supervision of our subsidiary oversight division, each department is responsible for specific subsidiaries, ensuring respect for their business autonomy while requiring pre-approval or reporting on certain key matters to maintain effective governance.

Additionally, we have established compliance regulations that apply to the entire corporate group. To ensure that executives and employees uphold legal, corporate, and ethical standards, we have developed a Code of Conduct, distributed a Compliance Handbook translated into local languages, and implemented company-wide compliance frameworks.

Furthermore, we have established a Management Audit Department, which conducts internal audits across the corporate group. We also hold regular meetings and consultations with subsidiaries, fostering information-sharing, unified crisis management, and efficient business operations across the entire organization. - Matters Related to Directors and Employees Supporting the Audit & Supervisory Committee, Their Independence from Other Directors, and Ensuring the Effectiveness of Instructions

MJC has established a Management Audit Department, which assists the Audit & Supervisory Committee upon request in conducting audits. The administrative tasks related to committee meetings, minutes preparation, and other operational matters are handled by Management Audit Department staff and other designated personnel supporting the committee’s duties.

To ensure independence from other directors, decisions regarding appointment, transfer, and other personnel matters of the designated employees require prior approval from the Audit & Supervisory Committee. Additionally, employees assigned to perform audit-related tasks under the committee’s direction do not receive orders from other directors (excluding those serving on the committee). This structure reinforces their independence and ensures the effectiveness of audit-related directives. - System for Reporting to the Audit & Supervisory Committee by Directors, Auditors, Employees, and Other Relevant Parties within the MJC Group

A framework ensuring that directors (excluding Audit & Supervisory Committee members), auditors, employees, and other relevant parties within the MJC group can report to the Audit & Supervisory Committee when necessary

A system to ensure that individuals who report to the Audit & Supervisory Committee do not suffer any disadvantageous treatment due to disclosure

A system to enhance the effectiveness of audits by enabling thorough oversight and reporting mechanisms, ensuring compliance and corporate transparency across the organizationAudit Committee and Internal Reporting System

MJC has established a framework that enables the Audit Committee to receive regular reports on the execution of duties from directors (excluding directors who are members of the Audit Committee) or employees. Additionally, to ensure effective audits, our Internal Audit Department provides support to the Audit Committee in its functions.

Furthermore, through our internal reporting system, reports received by the responsible department from officers and employees of MJC or subsidiaries are communicated to the Audit Committee.

In addition, we regularly hold Audit Committee Liaison Meetings within MJC Group to facilitate information sharing between the Audit Committees and auditors of MJC and subsidiaries.

MJC is also committed to protecting whistleblowers. We strictly prohibit any disadvantageous treatment of individuals who report issues through the internal reporting system. Moreover, employees and officers within MJC Group who report to the Audit Committee are safeguarded from unfavorable consequences related to their reports. We ensure that this policy is clearly communicated and enforced across our organization. - Policy on Expenses and Liabilities Related to the Execution of Duties by Audit Committee Members (This applies only to the execution of duties related to the Audit Committee's functions.)

MJC allocates a fixed annual budget to cover expenses related to the execution of duties by Audit Committee members (limited to matters concerning the Audit Committee's functions). Additionally, when an Audit Committee member requests an advance payment for expenses incurred in the performance of their duties, we ensure prompt processing of such expenses or liabilities, unless it is determined that the requested amount is not necessary for the execution of the Audit Committee's duties.